From the June 2022 issue of Apollo. Preview and subscribe here.

There was a sense of burgeoning energy in the contemporary art scene last month as galleries prepared for the second London Gallery Weekend. More than 150 galleries took part, with many of the exhibitions still open. As at Frieze last October, a new generation of painters is much in evidence at the primary market galleries.

Pace presents the techno-music-inspired spray paintings of fantastical beasts by American artist Robert Nava (b. 1985) in his debut London show (until 25 June). At Pilar Corrias, Beijing-born Vivien Zhang (b. 1990) showed off her slick liquid painting technique that makes reference to digitally printed consumer imagery (closed 28 May). And intensely coloured patterned canvases that hover between abstraction and cartoons by Japanese-born Ayako Rokkaku (b. 1982) can be found at König (until 11 June).

Gestural, faux-naïf and Surrealist-inspired painting is all the rage. At London’s flagship contemporary art auctions in March, startling prices were paid for painters such asIssy Wood (b. 1993), Jadé Fadojutimi (b. 1993) and Flora Yukhnovich (b. 1990), among others. Wood’s spooky oil-on-velvet Chalet (2019) sold for £441,000; Fadojutimi’s Acquainted Intruder (2018) went for £942,000 and Yukhnovich’s Warm, Wet ‘N’ Wild (2020) made an extraordinary £2.7m.

It’s not just in London where this is happening: at international auctions, huge prices are being paid for works by young painters – a trend that started when the pandemic took hold. This is all the more surprising as, outside a narrow section of the art market, many of the artists who have flown way over their estimates at auction are barely known. Many are too early in their careers to have solid exhibition track records at non-commercial spaces, let alone solo shows at significant museums.

It is a situation that used to be known, unflatteringly, as ‘made by the market’ – an artist’s prices boosted by speculation and hype. Knowing critics would predict that such a rapid rise can only be followed by an equally speedy fall; not so, say their supporters. As growing numbers of younger collectors enter the market, especially from Asia and the US tech sector, the usual factors that slowly drive an artist’s success, including a raft of monographic museum shows, no longer apply.

Frozen Bark (2021), Robert Nava. Sotheby’s London, £478,800

Sotheby’s introduced new series ‘The Now’ in November 2021 to cater to this audience and to compete with Phillips, which has carved out a niche in selling this kind of ultra-contemporary art. David Galperin, Sotheby’s head of contemporary art, Americas, says: ‘This market has been growing for the past few years. It’s not the same market as for post-war and classic contemporary art.’ Figures from auction data provider Artprice bear this out: in 2000 it estimated that artists under 35 in its database accounted for less than $10m in auction sales. By 2021 this had ballooned to just under $120m, 30 per cent higher even than the record figures of 2008, at the end of the last art market boom.

Galperin argues that because the post-war category starts in 1945 ‘there was an opportunity to separate out the present century into a different category altogether’. New collectors, he says, want to buy art made by people similar in age ‘but it is very difficult for them to participate because of the hoops they have to jump through. There’s so much demand but supply is scarce because it is extremely controlled by the primary market dealers.’

Enthusiasm is whipped up by Instagram, digital media and online bidding. In London’s March edition of the ‘The Now’, 50 per cent of bidders came from Asia, often China. Primary dealers, meanwhile, do not disagree with Galperin: they say their role is to manage an artist’s reputation, placing works carefully with established collectors and museums, and to guard against speculation.

The result is wide discrepancies between primary and secondary markets. Nava’s works, for example, were priced at $35,000 to $50,000 in early 2021 at a sold-out show at Pace in Palm Beach. At auction, his record – set for Frozen Bark (2021) – is almost £480,000. Pippy Houldsworth gallery sold a work by Fadojutimi at Frieze art fair for under £130,000 at the same time her auction record – just under £1.2m – was being set at Phillips.

Victoria Miro, meanwhile, told Scott Reyburn of the New York Times – who coined the term ‘red-chip’ to describe these ultra-hot artists – that it was keeping prices at its Yukhnovich gallery show in February to between £100,000 and £350,000 and concentrating on collectors where ‘any acquisition will be on long-term hold’. But even primary market prices at this level for such young artists are high, says Lisa Schiff, a leading New York art advisor. ‘Even the greatest young artist has a lot to prove,’ she says. ‘Critical, aesthetic and financial value should be inextricably linked through consensus-making, through museums, curators, collectors, other artists – the whole system coming together.’

This process used to be painfully slow. Gerhard Richter, one of the greatest living artists, was 66 when a painting of his first sold at auction for more than $1m in 1998. By then he had had more than 50 solo exhibitions at museums big and small, including the Pompidou, Hirshhorn and Tate, and he had represented Germany at the Venice Biennale.

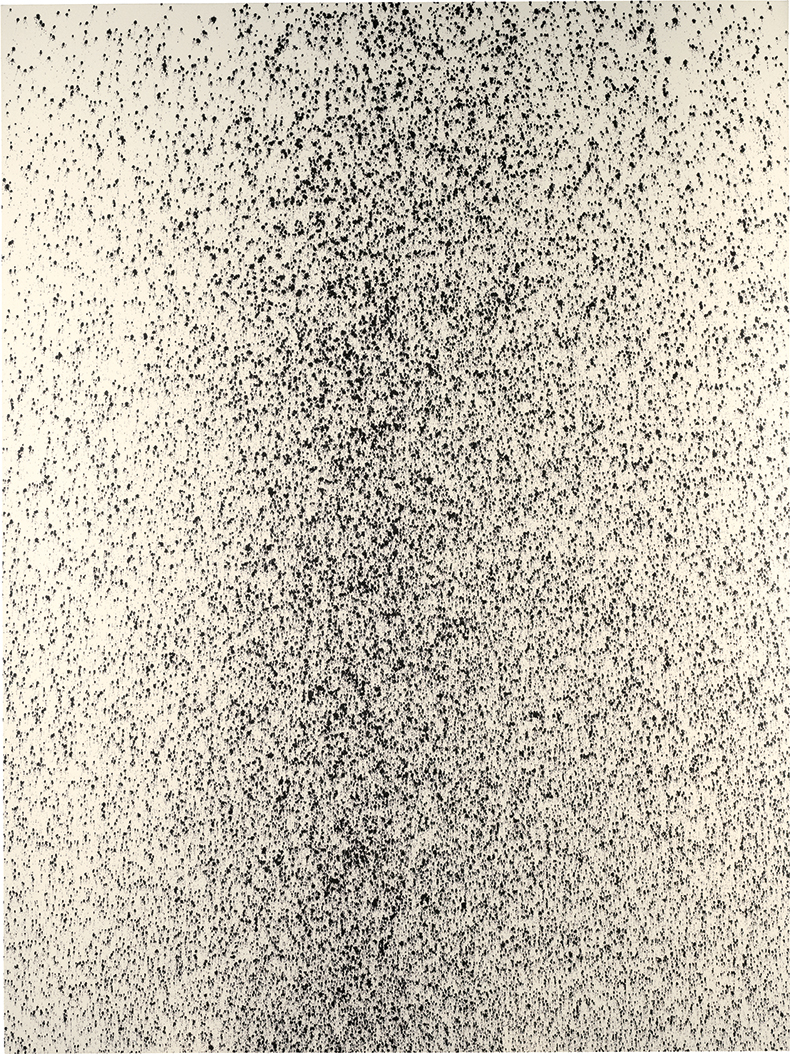

Two sides of the same coin (2012), Lucien Smith. Sotheby’s London, £224,500

While many artists no longer have to wait until retirement age to be recognised, some of the new art market stars have so far only been included in group museum shows. ‘What we are seeing is more of a fan-based economy,’ Schiff says. It is much the same trend as has been seen for ‘art’ NFTs. Unless museums start collecting them, they exist in an open market free of any kind of artistic validation.

When they occur, art market bubbles can hurt artists’ reputations, as well as collectors’ pockets, when they burst. In the mid 2010s a loose group of artists, mainly from New York making paintings in a style dubbed ‘process-based abstraction’, became the centre of a feeding frenzy. Lucien Smith (b. 1989), a young artist only a few years out of art school, saw prices for his work shoot to almost $400,000, a stratospheric amount for the time. Soon derided – the art critic Walter Robinson famously called the style ‘zombie formalism’ and Jerry Saltz of New York magazine described it as ‘visual muzak’ – this year, the average auction price for his work was just under $23,000.

It is inevitable that in a globalised and diversified art world no museum will have the influence that, say, the Museum of Modern Art did when its founding director Alfred Barr put New York’s artists at the centre of art history. Taste, scholarship, collecting and exhibiting have fragmented into a thousand strands. There are now more than 3,000 prominent art museums around the world and at least 7,000 commercial galleries that make it into the better art fairs – not to mention millions of people posting art on social media platforms.

But for all its faults, the validation system provided by disinterested scholars and curators in museums is still the only way we have to judge the importance and value of works of art. So what about those artists who command high prices and sustain long careers with no serious museum validation? Unheard of, as yet.

Additional research by Tom Forwood, Critical Edge.

From the June 2022 issue of Apollo. Preview and subscribe here.

![Masterpiece [Re]discovery 2022. Photo: Ben Fisher Photography, courtesy of Masterpiece London](http://zephr.apollo-magazine.com/wp-content/uploads/2022/07/MPL2022_4263.jpg)

‘Like landscape, his objects seem to breathe’: Gordon Baldwin (1932–2025)